33+ mortgage interest tax deductions

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of. Over 12M Americans Filed 100 Free With TurboTax Last Year.

I 5 1 I 15x The Income Tax Act Ministry Of Justice

Learn More At AARP.

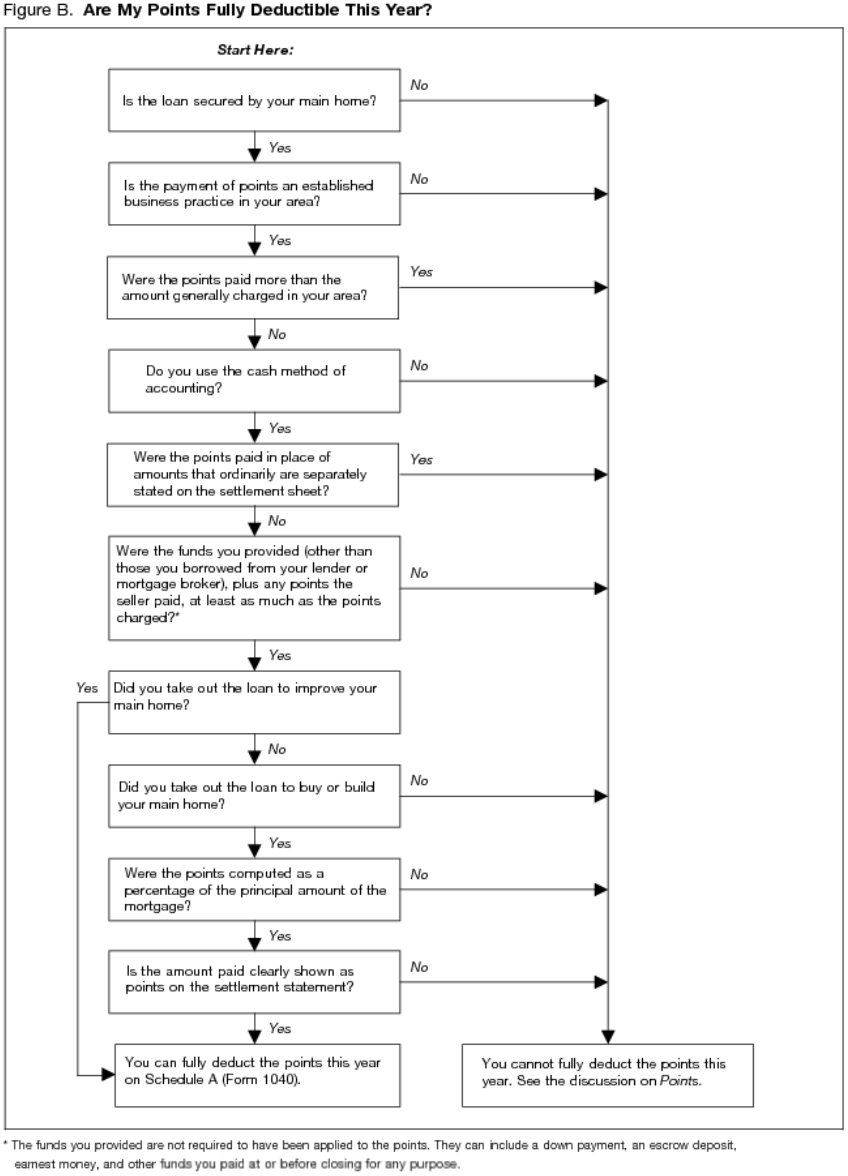

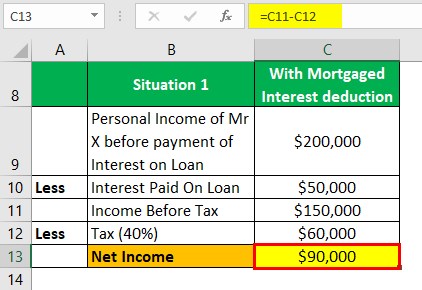

. Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Web 3 Replies. Web Here is an example of what will be the scenario to some people.

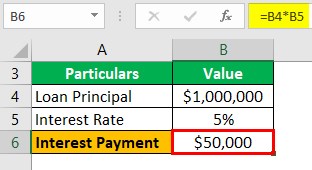

You may qualify for a medical expense deduction if you install special equipment in or make modifications to. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. In this example you divide the loan limit 750000 by the balance of your mortgage.

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. See If You Qualify Today.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web Is mortgage interest tax deductible. Register and Subscribe Now to Work on Pub 936 More Fillable Forms.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web The average rate on a 30-year fixed mortgage fell by 017 in the last week to 701. Web Deduction of Medically Necessary Home Improvements.

Web Here are the allowed deductions I have. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. If you entered your Mortgage Interest directly on the Home Mortgage Interest Worksheet and an amount did not transfer to Schedule A you may.

Complete Edit or Print Tax Forms Instantly. Web The deduction for mortgage interest is available to taxpayers who choose to itemize. So the total Interest that is 1000000 5 50000 will be deducted from the total.

However higher limitations 1 million 500000 if married. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

12950 for tax year 2022. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Mortgage Interest and Refinancing 2232900 Property Real Estate Taxes 660500 Child and Other Dependent Tax.

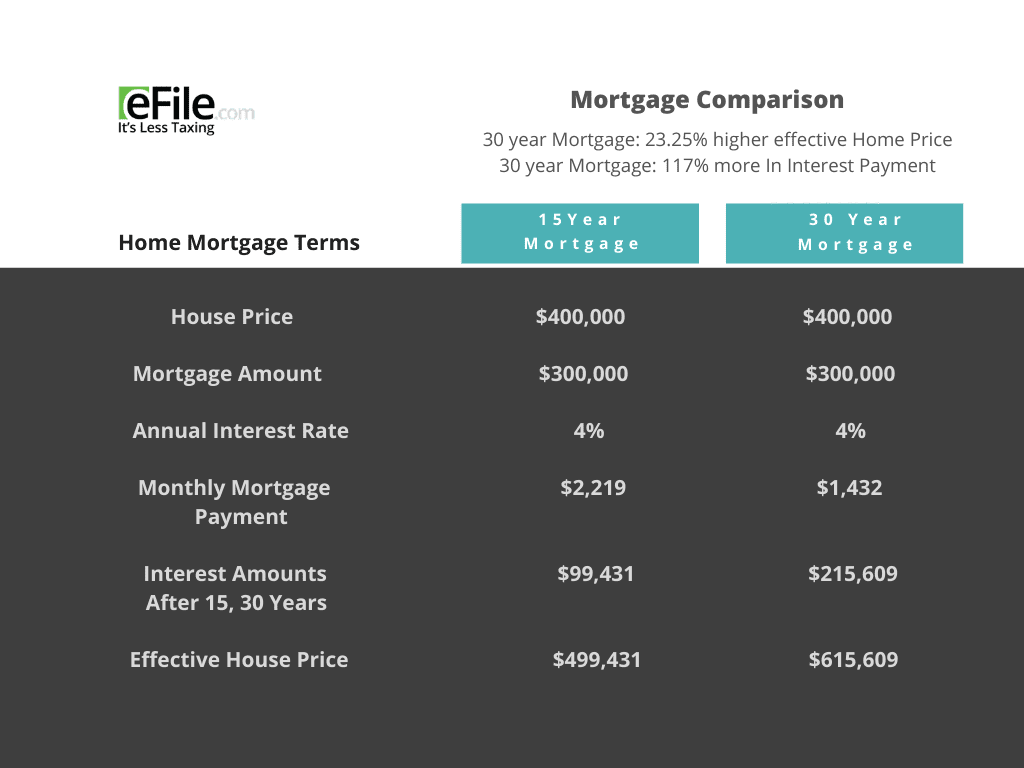

Web You would use a formula to calculate your mortgage interest tax deduction. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Single taxpayers and married taxpayers who file separate returns. Web Standard deduction rates are as follows.

That means that the mortgage interest you. Ad Access Tax Forms. Meanwhile the average rate on a 15-year fixed mortgage climbed 001.

Web This form will state exactly how much you paid in interest and mortgage points over the course of the year and act as proof that youre entitled to receive a.

Tax Credit Vs Tax Deduction What Are They Features Infographics

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Wahl 8685 Peanut Classic Clipper Trimmer Amazon De Beauty

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Tax News Flash Issue 101 Kpmg Thailand

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

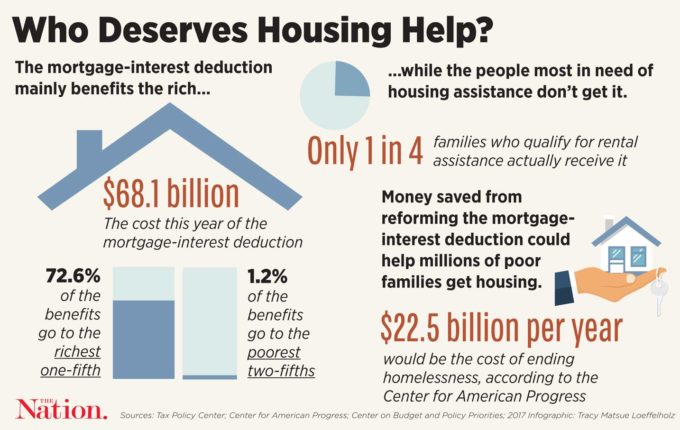

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Home Mortgage Loan Interest Payments Points Deduction

33 Stub Templates In Pdf

Annual Report 2003 2004

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Mortgage Interest Deduction How It Calculate Tax Savings